Uninspired but not surprised - and that is fine

Mony hasn’t told me anything I didn’t already expect, but it’s another stock to have taken a disappointing chunk out of my still-quite-new portfolio

I didn’t love yesterday’s announcement from Mony.

As an aside, I also don’t really like the company’s new(ish) name. Moneysupermarket.com was a bit of a handful, but at least it didn’t look like a typo - my Google doc keeps trying to autocorrect to add the ‘e’. I hope by the end of this article it will have learned that I am actually trying to write the word Mony, not money.

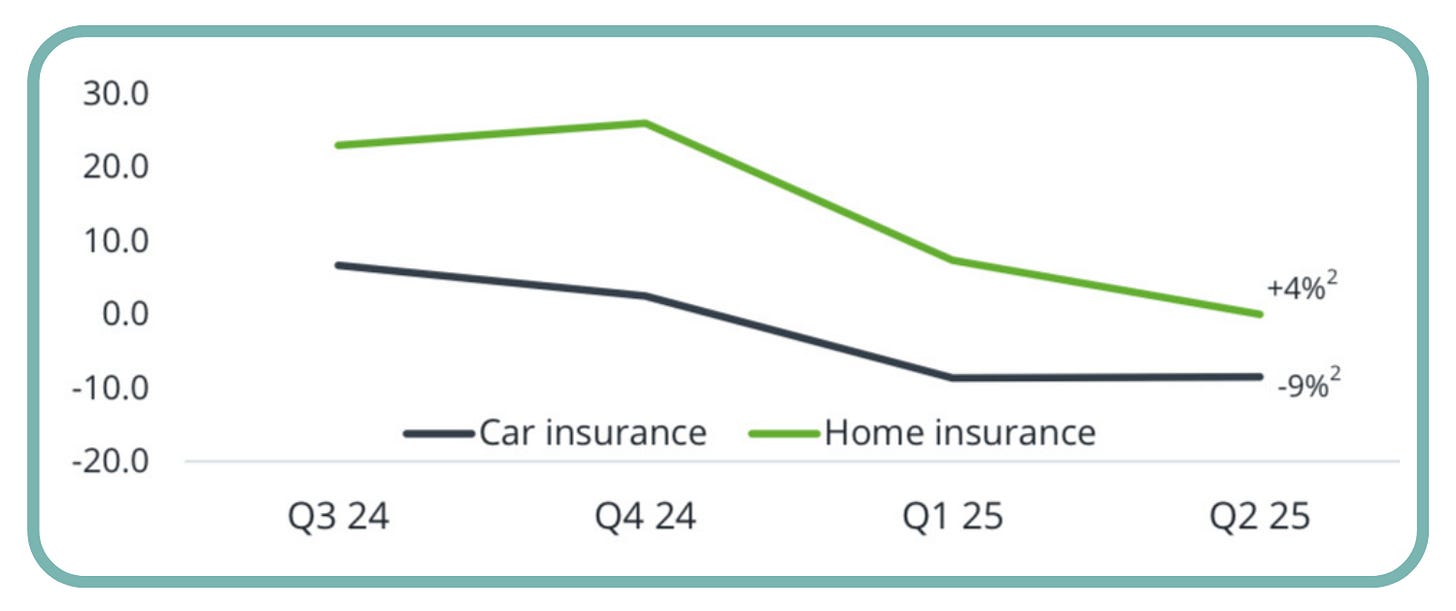

But while these interim numbers don’t make for the best reading, I am not surprised by them and the market shouldn’t be either. Insurance premiums are not experiencing the same mind-bending inflation as they were a few years ago, which means fewer people are desperate to regularly switch providers and there is therefore less of a need for regular perusal of Moneysupermarket.com.

In the first half of 2025, these unhelpful trends were particularly noticeable in the car insurance market. Car insurance premiums have fallen 9% in the last six months - good news for drivers, but less so for Mony. The company’s overall insurance business reported a 2% decline in revenues.

And as insurance contributes more than 50% of the total top line at Mony, it’s really not surprising that the weakness in that market has impacted group revenue growth, which was held to just 1% in the first half of the year.